OnlyFans W-9 explained: What you need to know

Navigate OnlyFans taxes like a pro: Avoid errors, stay compliant, and thrive as a content creator.

Savannah

Jul 16, 2024

Navigating the administrative side of being an OnlyFans Creator means dealing with tax forms like the W-9.

In this guide, we'll explain everything you need to know about the OnlyFans W-9, from its purpose and significance to what it means for your tax obligations.

Whether you're a seasoned Creator or just starting out, understanding this document is essential for staying on the right side of the IRS.

So, let's jump right in and unravel the mysteries of the OnlyFans W-9 to ensure that you're well-equipped to navigate tax season as a content creator.

Understanding your tax obligations

According to the IRS, OnlyFans Creators are considered self-employed and have to pay income tax on the money they earn. Self-employment tax includes Social Security and Medicare taxes.

If you are employed and get your salary from an employer, these taxes are automatically taken from your pay. But as a self-employed person, you have to calculate and pay your own taxes.

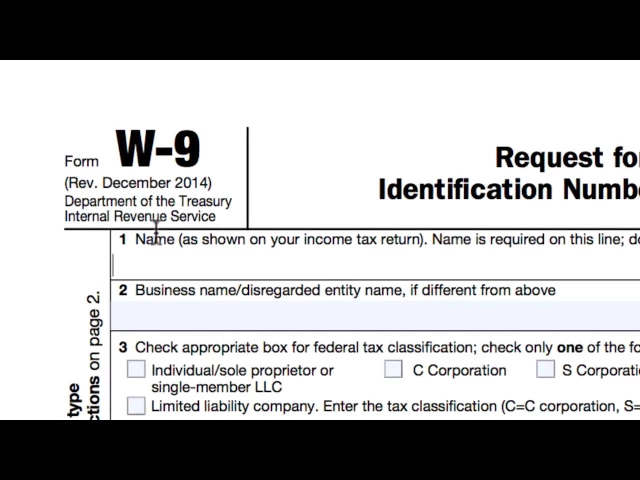

What is a W-9 and why do I need It?

A W-9 form is a document used by the IRS in the United States to collect details about a taxpayer—typically someone working as an independent contractor or freelancer.

When you're hired for a job, and the payment is expected to be $600 or more in a tax year, you'll likely be asked to complete a W-9.

This document gathers your name, address, and taxpayer identification number (your Social Security number or employer identification number).

As an OnlyFans Creator, you have to fill out a W-9 form because it provides the platform with the information they need so that they can report your earnings to the IRS properly.

OnlyFans uses the information on your W-9 to generate a 1099-MISC or 1099-NEC form, which reports the amount of money you've made during the year.

Providing accurate information on your W-9 is essential in making sure you don’t break any tax laws.

OnlyFans W-9 requirements

When you sign up to become a Creator on OnlyFans, you will have to fill out your W-9 form before you can start doing anything on the platforms.

Here’s the information you'll have to include:

Your legal name. Make sure it matches the name on your tax return.

Business name (if applicable). If your business name differs from your legal name, include it.

Your Taxpayer Identification Number (TIN). This can be your Social Security Number (SSN) or Employer Identification Number (EIN) if you've registered your OnlyFans as a business.

Your address. Input the address where you prefer to receive your mail.

Certification of your TIN. Confirm that the number you've provided is correct.

How to fill out the W-9 for OnlyFans

Here are detailed instructions for how to fill out your W-9 form for OnlyFans:

1. OnlyFans will give you a digital W-9 form when you sign up.

2. Fill in your full legal name in the “Name” section.

3. If you have a business name, add it in the "Business name/disregarded entity name" part.

4. Check the appropriate box for federal tax classification (individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/Estate.)

5. Fill in your full address, including city, state, and ZIP code.

6. Fill in your Social Security Number or Employer Identification Number.

7. Sign and date the form.

8. Submit the form.

Common W-9 mistakes

Ensuring accuracy when filling out your W-9 form is crucial to avoid future tax headaches.

Here are some common mistakes to avoid:

Missing information. Fill out every section of the W-9 unless it's labeled optional.

Invalid TIN: Using an incorrect Social Security Number (SSN) or Employer Identification Number (EIN) can cause IRS mismatches. Double-check your TIN to avoid this.

Name discrepancies: The name on your W-9 has to be the same as the same on your tax return. This means that you can’t use your OnlyFans alias here.

Incorrect tax classification. Your tax classification determines your tax rates and deductions, so it's important to choose the right classification. Familiarize yourself with the different classifications so you know which one applies to you.

It's important for OnlyFans Creators on OnlyFans to understand the ins and outs of the W-9 form so they can stay on the right side of the IRS.

Accuracy matters—make sure you complete each section, double check your TIN, and use the same legal name on all your tax documents. If you make any mistakes, fix them right away to avoid penalties.

If you’re having trouble, seek help from a tax professional or reach out to other Creators in the community.

Once you’ve mastered your W-9, you can focus on what you do best—creating content.